Last April, the Food and Drug Administration approved Seres Therapeutics’ Vowst, the nation’s first microbiome-based prescription product. In so doing, the agency quietly opened up an entirely new, potentially vast product category.

Indicated for the prevention of recurrent Clostridioides difficile (aka “C diff”) infection in adults, Vowst contains live microbial spores derived from healthy human feces. In essence, it’s a fecal microbiome transplant in capsule form.

FDA’s approval of Vowst was supported by two clinical studies—one placebo-controlled, the other open-label—involving a total of 346 patients with severe recurrent C. difficile.

In the placebo-controlled trial, Vowst-treated patients had a markedly lower 8-week recurrence rate compared with those in the placebo group: 12.4%, versus 39.8% (Feuerstadt P, et al. N Engl J Med. 2022). Both groups had been previously treated with standard antibiotic drugs for C. difficile.

Though there were some adverse effects associated with Vowst (abdominal bloating, fatigue, constipation, chills and diarrhea), it was generally safe and well-tolerated, and the FDA’s reviewers hold that its potential benefits far outweigh its downsides.

Broad Implications

Vowst is approved for a very narrow indication: prevention of C. difficile recurrences in adults previously treated with antibiotics. And Seres has emphatically stated that the product is not intended as a first line therapy for acute C. difficile.

But the implications of Vowst’s approval are broad; it’s the first FDA-approved microbiome-based therapy, but very likely not the last.

Though Vowst is not a probiotic, its emergence raises a big question with significant implications for the holistic and functional medicine world: Are Rx probiotics on the horizon?

For the near future, the answer is, “Probably not.” But longer term, it is a real possibility.

Microbiome Gold Rush

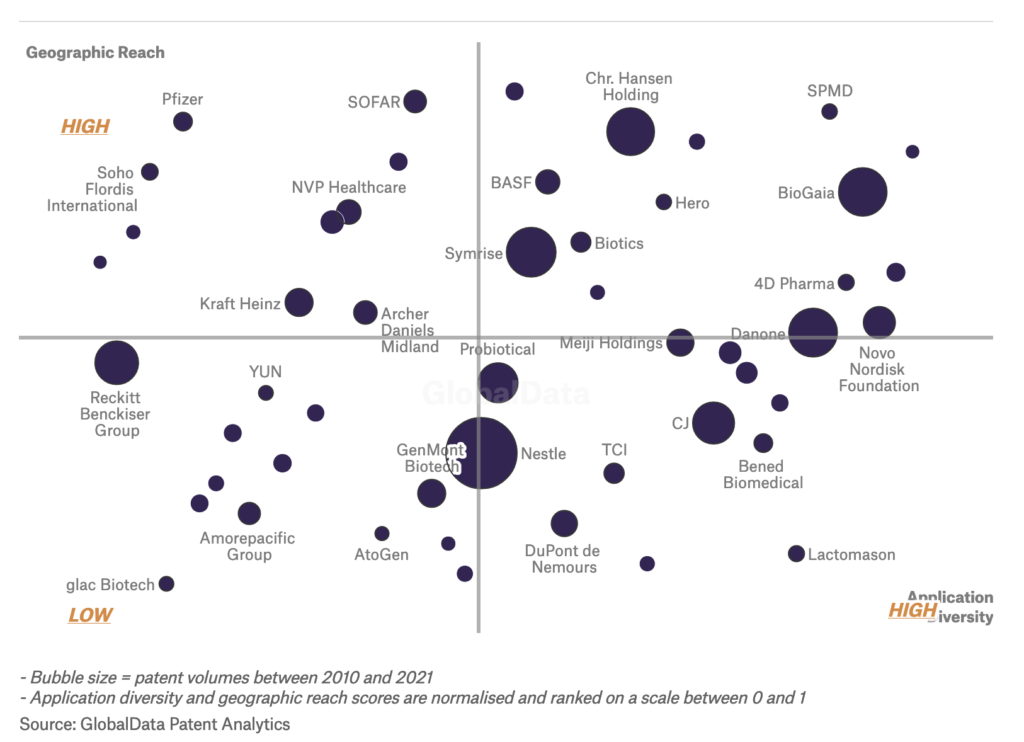

At present, there are more than 130 different companies across the pharmaceutical, biotech, and food/beverage sectors working on patented probiotics and microbiome-based therapies, according to market research firm, Global Data. In the past three years, companies have filed more than 633,000 microbiome-related patent applications.

The data suggest Nestlé has taken the lead in terms of total number of patents and partnerships in the microbiome therapeutics space. Nestlé’s Health Science division partnered with Seres to launch Vowst in the US and Canadian medical markets. A press release following the FDA’s approval of the product notes that Nestlé invested $125 million in the launch.

Beyond Vowst, Nestlé is also developing its own lactobacillus-based weight management product. Whether that will ultimately come to market as a supplement, food ingredient, or medical food remains to be seen.

Nestlé is not a drug company, per se. But in recent years, it has started to act a lot like one, as STAT business writer Rebecca Robbins notes in her 2018 report on the company.

The global giant has moved away from the candy, ice cream, and dairy products for which it is best known, and taken a stronger position in healthcare. Greg Behar, Nestlé Heath Science’s CEO since 2014, has an extensive pharma background, having spent years in top roles at Boehringer Ingelheim. Since Behar took the helm, Nestlé has acquired or partnered with several innovative biotech startups, including Seres.

In 2018, Nestlé acquired the Atrium Innovations portfolio of companies, which gave the company a dominant position in the practitioner-focused dietary supplements channel. In acquiring Atrium, Nestlé took ownership of Pure Encapsulations, Douglas Laboratories, and other “professional” brands, as well as the popular direct-to-consumer brand, Garden of Life.

Microbiome Macroecomics

Other pharma and healthcare brands have also ventured into the microbiome. According to Global Data, Pfizer, NovoNordisk, and DuPont de Nemours all have microbiome-based products in the works. In a 2021 article for Genetic Engineering & Biotechnology News, industry consultant Jean-François Denault notes that Boehringer, Takeda, Gilead, Novozymes, and Merck have all entered deals—large and small—with probiotic/microbiome-focused biotech companies.

Johnson & Johnson, via its Swiss subsidiary, Cilag GmbH, is also prospecting the microbiome. In 2018, Cilag announced a long-term agreement with Probi—a Swedish probiotics maker—to develop new microbiome modulation agents based on Probi’s cornerstone Lactobacillus plantarum LP299V® strain.

In the UK, OptiBiotix Health is using a different L. plantarum strain to create products targeting hypertension, dyslipidemia, and cardiovascular disease. Several years ago, OptiBiotix announced a partnership with an unnamed US drug company to bring its branded strains into the US market, and to potentially develop products outside the food and dietary supplements categories.

AstraZeneca, an early investor in Seres, has its own Microbiome Discovery lab, dedicated to “Unlocking the microbiome to discover new drugs within you.”

On its website, AstraZeneca highlights the relationship between microbiome changes and a range of human respiratory, metabolic, neoplastic, and inflammatory diseases.

“The microbiome represents a new, untapped frontier for biomarker identification and drug discovery. Utilising technological advances which enable analysis of large datasets and the disease area expertise present across our organisation, we are unlocking the potential of the microbiome to identify actionable biomarkers and bring novel therapies to patients,” says Taylor Cohen, Director of Microbiome Discovery, on AstraZeneca’s site.

That’s a familiar song to any practitioner of holistic, functional, or naturopathic medicine. But it’s only recently that Big Pharma has joined the chorus.

None of the drug companies mentioned above has brought a prescription probiotic to market. But Cohen’s statement does make it sound like that’s where AstraZeneca—and the drug industry at large—are heading.

The Rise of “Condition-Specificity”

Meanwhile, on the supplements side, probiotic brands–and their raw materials suppliers–have become more pharma-esque in the ways they develop and market their products. Condition specificity is the new watchword; strain specificity is the key to achieving it.

The gut microbiome remains central to the story, but we now have myriad other subplots, via the various “axes” that researchers have described. There’s a Gut-Brain Axis, a Gut-Liver Axis, a Gut-Vaginal Axis, a Gut-Lung Axis, and likely several others.

This means that probiotics and other microbiome-modulating therapies have relevance far beyond gut health. Whether they reach market as supplements, OTC, or Rx, they have potential as treatments for a very wide range of conditions.

Supplement companies are still prohibited from making disease treatment claims for probiotics, but many are playing close to the line in their promotional language. Some brands have branched out from simple general health and gut health claims, toward much more organ- and condition-specific marketing propositions.

Live Biotherapeutics

For example, Seed Health—a Los Angeles based brand exclusively focused on strain-specific probiotics initially entered the market with its DS-01 Daily Synbiotic for overall gut health. Recently, Seed introduced probiotic blends promising dermatologic, cardiovascular, and immunologic benefits.

Seed has research partnerships with major institutions, including the National Institutes of Health, Massachusetts General Hospital, University of California Los Angeles, Imperial College of London, Baylor College of Medicine, and the Cleveland Clinic.

The language on the company’s website shows a notable shift away from typical dietary supplement “structure/function” language. Seed describes its offerings as “Live Biotherapeutic Products (LBPs),” which are, “are regulated as drugs by the FDA and range from single microbes with defined pharmacological properties to entire ecosystems that can prevent and treat infection.”

The statement goes on to say that, “Our ‘living medicines’ have extensive safety data in a human population, target conditions that impact large global communities, and can be clinically validated at a fraction of the cost of a small molecule.”

In 2020, Seed spun off its Luca Biologics subdivision, which is focused on live biotherapeutics to prevent and treat vaginal dysbiosis and other women’s health conditions. The products are based largely on the work of University of Maryland microbiologist Jacques Ravel. Luca’s pipeline includes products targeting urinary tract infections, bacterial vaginosis, and even something that could potentially prevent pre-term births.

On Luca’s website, Dr. Ravel states: “Living medicines will disrupt the way we approach many diseases—and in some cases, may even replace the primary standard of care.”

ResBiotic & the Gut-Lung Axis

ResBiotic, another new and innovative brand, has developed an oral probiotic/botanical combination called ResB that can effectively modulate the Gut-Lung microbial axis to improve the health of people with asthma and other respiratory conditions. And that’s on top of the general gastrointestinal and immune health benefits that users of ResB are likely to obtain.

ResB contains three trademarked strains of Lactobacillus (Lactiplantibacillus plantarum RSB11™, L. acidophilus RSB12™, and L. rhamnosus RSB13™) combined with three herbs known for lung support and anti-inflammatory effects: Vasaka (Adhatoda vasica) leaf, Holy Basil (Ocimum sanctum) leaf, and Turmeric (Curcuma longa) root.

The three Lactobacillius strains produce specific short-chain fatty acids that are absorbed from the gut into blood circulation, and then transported to the lungs where they influence immune function and promote clearing of mucus.

ResBiotic’s founder, C. Vivek Lal, MD, is a neonatal intensive care physician, who also heads a pulmonology microbiome lab at the University of Alabama, Birmingham.

In addition to Resbiotic, Lal also owns Alveolus Bio, a company that develops inhaled biotherapeutics for chronic obstructive pulmonary disorder (COPD) and other severe respiratory disorders.

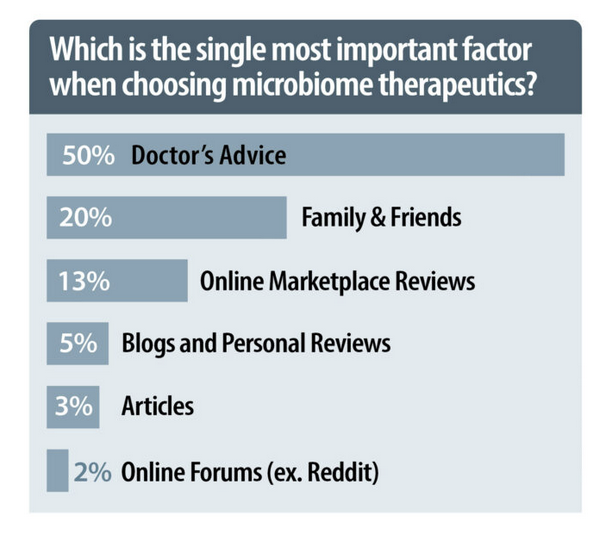

Though ResBiotic is playing squarely on the supplement side of the regulatory divide, Dr. Lal’s conventional medical training, scientific experience, and commitment to clinical research shape everything about the company, and give the products a quasi-pharma pedigree that he believes will be welcomed by physicians.

After years of pre-clinical work, ResBiotic recently published its first open-label human safety trial involving 11 healthy individuals and 11 asthmatic patients treated with the ResB formula daily for four weeks (see The Gut Lung Axis: Implications for Asthma Care).

The asthmatic patients showed significant improvements in standard measures of lung function (FEV1) compared with baseline, an effect not seen in the non-asthmatic subset. Using strain-specific PCR techniques, the researchers showed that supplementation with the probiotic-herb combination produced the expected increase in the abundance of probiotic strains, though it did not cause major changes in gut microbiome ecology.

In an interview with Holistic Primary Care, Dr. Lal explained that people with asthma and other chronic respiratory disorders often have concurrent dysbiosis which can, potentially, be remedied with probiotics. He added that the beneficial anti-inflammatory effects across the gut-lung axis are mediated primarily by short-chain fatty acids (SCFAs) produced by certain gut bacteria.

There were no significant adverse effects associated with ResB in this small study. Lal says further clinical trials are underway.

“We, as physicians, are very adamant about clinical trials. While there is a huge role for complementary medicines and supplements, the truth is that 95% of the products out there on the shelves are not really science-backed. How do we bring scientific rigor to this field so there is authenticity, accountability, and efficacy?” he remarked.

“It is very difficult to do what we are doing. It is time- and cost-intensive. But doctors would not take this seriously—and I myself would not take it seriously—if we were not doing the pre-clinical and clinical studies.”

Seed and ResBiotic are just two examples of microbiome-focused companies that have positioned products for the management of specific disorders and clinical conditions. There are many others.

As this trend continues, the line between traditional probiotic supplements, “living biotherapeutics,” and prescription drugs will become increasingly blurred—unless regulators step in to sharpen that boundary.

The Vowst approval has opened space for an entirely new category of microbiome-based products that are neither probiotics in the sense that most practitioners and patients understand them, nor old-school traditional drugs. Rather, they are prescription-only products that modulate aspects of the microbiome to obtain specific clinical outcomes.

Will we see emergence of an Rx probiotic in the next 10 years? It’s hard to say. The reality is, bringing a drug to market is long, arduous, and expensive. And probiotics tend not to behave in a simple, direct, ‘single agent, single effect” way. That means they don’t fit easily into drug research models.

While there are no Rx probiotics yet, there’s no question that “microbiome modulation” is a hot concern for biotech, pharma, and supplement companies alike.

In the near future, we’ll see a lot more companies entering “living biological therapies” space. Right now, this is a regulatory gray zone, and innovations like Vowst are probably not a significant threat to the fast-growing probiotic supplements market.

But give it another few years, and a few billion more in global investments, and it could be a very different picture.

END