For health insurers, the COVID pandemic has been a goldmine. At least so far.

Across the nation, ordinary people and small businesses struggle with both the disease itself and the fiscal consequences of prolonged economic shutdown. Healthcare plans, on the other hand, are poised to make record profits this year.

According to a mid-April NASDAQ report, seven of the biggest for-profit players—UnitedHealth Group, Centene, Cigna, Anthem, Humana, Molina, and Magellan–are expected to turn “positive earning surprises” in 2020. For all of them, stock performances are surpassing previous years’ projections.

UnitedHealth Group (UNH), the nation’s largest employer of medical professionals, saw a nearly 7% revenue rise in Q1 2020, reaching $64.4 billion. During that three-month period—as COVID spread across the country–UHG’s medical loss ratio decreased by 1% compared with Q1 2019. In laymen’s terms, “medical loss” means money spent on actual medical care.

Bull Run for Some

Like other major insurers, UNH’s stock price remained high throughout the first months of the pandemic. At the close of Q1, UNH was trading at $277.50 per share, up 2.6% from the beginning of the year; it continues to generate earnings and dividends.

According to the company’s Q1 report, “Return on equity of 23.6% continued to reflect the company’s strong overall margin profile. Dividend payments grew 19.1% year-over-year to $1.0 billion and the company repurchased 6.2 million shares for $1.7 billion in first quarter 2020.”

Yes, that’s right. Instead of using its Q1 windfall to reduce premiums for furloughed workers and businesses tottering on the brink of bankruptcy, UnitedHealth bought back its own stock, to ensure that its stock prices remain buoyant.

It is also noteworthy that UnitedHealth’s president, Sir Andrew Witty, also CEO of UNH’s highly profitable Optum division, took “a leave of absence” this Spring to work with the World Health Organization on COVID-19 vaccine development. Prior to UNH, Witty was CEO of the drug giant, GlaxoSmithKline.

Aetna, is also having a bull run, despite the pandemic—or perhaps because of it. CVS—which owns Aetna—reported a net income of $2.01 billion in the first quarter.

In his Q1 2020 report, CEO Larry Merlo stated, “Consolidated revenues increased 8.3% year-over-year with growth coming from all segments. Our business performance exceeded our expectations due in part to strong execution and our ability to meet elevated consumer and member needs resulting from COVID-19. We generated $3.3 billion of cash from operations and returned approximately $650 million to shareholders through cash dividends in Q1.”

Merlo’s personal compensation package in 2019 was just shy of $22 million.

Second Wave? No Problem

Not all health insurance companies are booming. But most are doing just fine, prompting Moody’s Investor Services to report in late May that, “Coronavirus-related costs did not “materially impact” seven major health insurance companies’ first quarter 2020 earnings, which increased slightly over last year.”

That’s why Moody’s predicts that the majors will remain profitable even if there is a second wave of COVID.

Several factors play into the insurance industry’s COVID cakewalk:

- Despite the economic shutdowns, insurers continue to collect premiums from employers, the federal government (for Medicare Advantage and other privatized federal insurance plans), and insured individuals.

- For most plans, the medical loss –that is, the percentage of premium revenue spent on actual care for beneficiaries—is down significantly since the pandemic. That’s because so many clinics have closed, and so much sub-acute, elective, and ‘non-essential’ care has been deferred.

- Prolonged quarantines, bans on large gatherings, and travel restrictions mean fewer auto and motorcycle accidents, sports injuries, and episodes of non-COVID infectious diseases. All of this translates into fewer people racking up medical bills that insurers must pay.

- The actual costs of COVID care are falling most heavily on federal payors, not private sector insurers. That’s because people with severe COVID are disproportionately elderly (Medicare), poor (Medicaid), or uninsured.

Fed Bears the Brunt

To be sure, insurers face storms on the horizon. More than 40 million Americans have lost their jobs since the pandemic began, and several big employers have declared bankruptcy. That means significant losses in employer-based insurance revenue. It remains to be seen how many companies rebound, and how many of those jobs are restored once “things go back to normal”—if ever they do.

There could also be a massive surge in medical spending once clinics reopen and people who deferred office visits and non-acute care feel safe enough to return.

But even in the face of these threats, the insurers have done much to ensure their future profitability (they are insurers, after all).

For one, many newly unemployed people will likely end up on the federal tab—either in Medicaid or Medicare—or they will scrimp and save to buy private insurance on the open markets. Even if the big plans lose revenue from employer premiums, they’ll likely save even more on reduced medical spending for beneficiaries they no longer have to cover.

Further, a significant chunk of federal healthcare spending will end up going to the for-profit plans anyway, via the Medicare Advantage plans.

According to Moody’s, COVID-related unemployment “will hurt fully insured commercial risk books of health insurers most, because membership will decline.” But the unemployment “will benefit the Medicaid and individual market [insurer] businesses, which will gain members.”

“HEROES” for Whom?

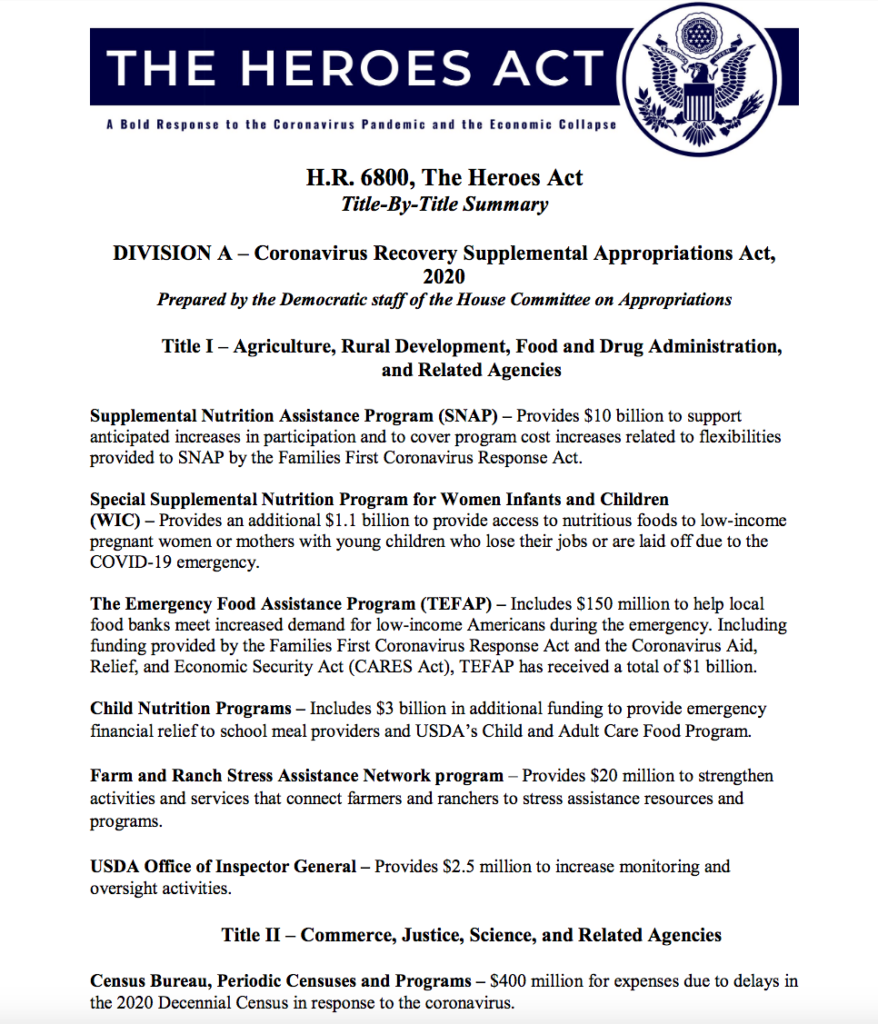

The insurance industry’s lobbyist sous-chefs have made sure the House of Representatives baked plenty of protections into the $3 trillion HEROES Act currently under Senate review.

HEROES (Health and Recovery Omnibus Emergency Solutions Act), a proposed follow up to the $2 trillion CARES (Coronavirus Aid, Relief, and Economic Security Act) includes subsidies for continued coverage of furloughed workers, or those using COBRA to extend their insurance while unemployed. It would also provide other funds to support employer-based plans.

In an April 28 letter to Senate and House leaders, a coalition of 32 medical organizations and trade groups—including the US Chamber of Commerce, and several insurance industry advocates—called on lawmakers to ensure that the employer-based coverage system does not collapse.

The coalition states that roughly 180 million Americans depend on job-based insurance—a frequent insurance industry talk-point– and urges Congress to “take immediate action to support employers and workers by protecting and expanding high quality, affordable health care coverage.”

The requested “action” includes:

- Subsidies to corporate employers that have lost revenue due to the pandemic and are forced to cut employee health benefits

- Full-cost offsets for COBRA coverage of people who’ve lost their jobs

- Expansion of “qualified expenses” in Health Savings Accounts, enabling people to use their HSAs to pay their insurance premiums

- A special enrollment period allowing people to buy insurance in the Health Insurance Marketplaces created by the Affordable Care Act.

- Subsidies for insurance purchased through the Marketplaces

Of course, it will take heroic efforts to get HEROES through the Republican-controlled Senate. The bill is a Democratic party initiative, and Senate Majority Leader Mitch McConnell has already voiced his opposition.

Whatever the fate of HEROES, it is a safe bet that the insurance plans will remain profitable.

“The one thing these companies know how to do is to make money, to assure their shareholders of a return on investment that Wall Street expects,” says Wendell Potter, a former insurance industry communications director turned whistle-blower.

Potter spent 15 years as the Vice President of Corporate Communications for Cigna, before a crisis of conscience obliged him to leave an industry he now sees as rapacious and only out for its own good, usually at the expense of patients and practitioners.

Protecting Profitability

“Insurance companies are really going to have a stellar year this year, because of the pandemic. And one of the reasons for that is because of all the elective procedures that have been cancelled or postponed. They’re not going to happen this calendar year. Some of those will never be rescheduled because unfortunately some of those individuals have died by now, or will die,” Potter said in a recent interview with Holistic Primary Care.

His experience in the corporate board rooms over decades has shown him that insurers are quite capable of weathering social and economic storms.

“Since the ACA was passed, insurance companies have made a lot of money. They’ve made record profits even with the restrictions that the ACA brought to the industry. The insurers can no longer refuse to sell coverage to people with preexisting conditions or charge people more because of their health status. But they can still charge older folks more than the younger people. And they’ve really ramped up prior authorization requirements. They’ve shifted more and more people into high deductible plans. They’re increasingly refusing to pay for coverage if you go out of network willingly or unwittingly,” says Potter, author of the 2010 book, Deadly Spin, which chronicles how the insurance industry manipulates public policy to its own advantage.

“So, there are things they put into place that are barriers to care, that protect their profits. Even if revenues drop next year, they will still have these things in place: people will still be in high deductible plans, probably more of them. And they can manage “medical expenses” in a certain way that, I would imagine their profit margins are not going to be adversely affected. Even with the drop-off in health plan enrollment and revenue, they still know how to convert their revenues to profit.”

COVID & Collusion

After several decades in the health insurance business, Potter says he’s rarely surprised by the degree of collusion between the big plans and the government.

But even he was taken aback when the Trump administration announced in April that it was contracting with UnitedHealth Group to oversee and disburse $26 billion in federal relief funds to COVID-stricken hospitals.

Rather than running the money through its usual Medicare and Medicaid payment channels, the government chose UnitedHealth—the country’s largest private, for-profit insurer–to administer and distribute the massive sum to hospitals and clinics that are running aground financially, owing to the impact of COVID.

UNH claims it is not profiting on the deal, and that the $1 million administrative fee that the government is paying will be donated to further hospital relief.

Friends in High Places

In his announcement of this arrangement, Health and Human Services Secretary Alex Azar claimed that UNH was better positioned “to expedite” the distribution of the money to hospitals where it is needed.

Potter says he smells a rat.

“The government, through CMS, makes payments to healthcare providers every single day. They’ve been doing it for more than 50 years. Why would you think that a private company could do it more expeditiously when they don’t even do business with all the hospitals in the US?

“They (UNH) are big. But they’re not as big as Medicare. They don’t have as many doctors and hospitals in their networks as does the Medicare program. So why in the world would the federal government turn to a private company that actually has fewer doctors and hospitals in network than Medicare? There’s no logical reason for that, except that it was a favor. It’s an example of what happens when you have friends in high places.”

The insurance industry is one of the largest sources of political campaign funding. United, being the biggest player on the field, doles out a lot of campaign cash on both sides of the aisle.

According to the Center for Responsive Politics’ Opensecrets.org website, UnitedHealth—through its political action committees and through donations by individual executives—is ranked number 126 in a list of 5,500 biggest Washington lobbyists, and 111th in a list of over 19,000 sources of campaign contributions.

Potter points out that President Trump himself, as well as Vice President Mike Pence, CMS Administrator Seema Verma, who was a close advisor to Pence, and many top officials in the administration are, “very favorable to private industry, to private insurance companies.”

Push for Privatization

“They strongly encourage people to enroll in Medicare Advantage plans. They want to convert the Medicare program to a program that is entirely run by the (private) insurance companies. That has long been an objective of a number of Republican politicians. Over the years they just developed relationships with the executives of these big companies, as they have sought to turn more and more of these public programs over to private insurers.”

Steven Parente, of the White House Council of Economic Advisers, is among the people in charge of managing the hospital COVID relief program. Prior to this position, he served as a business consultant to a number of major corporations, including—guess who? UnitedHealth Group.

As reported on the Politico website earlier this year, just a few months after Trump installed Parente in his current HHS post, UnitedHealth made a $1.2 million multi-year donation to Parente’s research center at the University of Minnesota. A curious coincidence, is it not?

Beyond UNH’s involvement in distributing the money, there are other questionable issues regarding the government’s hospital bail-out plan.

Disbursement of the $26 billion is based on how much hospitals were reimbursed in 2019 under the traditional Medicare Fee for Service programs—that is, Medicare Part A and Part B contracts.

Critics, like Erin O’Malley, senior policy director for America’s Essential Hospitals, is concerned that the plan will direct more money into the hospitals with big private-sector Medicare Advantage contracts, and less into those with high proportions of “traditional” Medicare and uninsured patients.

“We’re worried that by only looking at Medicare fee for service revenues, it could tilt the playing field against some of our members that have a disproportionate share of uninsured as well as Medicaid patients,” said O’Malley, in an interview posted on CNBC in April.

Sheep’s Clothing

Wendell Potter says that in times of crisis—like the current pandemic—insurers go into overdrive trying to make themselves look like good guys, concerned with public well-being.

Case in point, Potter’s former employer– Cigna—and its announcement that it will waive “all customer cost-sharing and co-payments for COVID-19 treatment.”

“Our customers with COVID-19 should focus on fighting this virus and preventing its spread,” said David M. Cordani, the company’s president and CEO, whose personal compensation package totaled more than $19 million last year. “While our customers focus on regaining their health, we have their backs. Our teams of experts are working around the clock to support front line health care workers, increase flexibility for hospitals, and deliver greater peace of mind to those we serve.”

Dropping co-payments? Sounds generous. Potter says it’s little more than corporate PR.

Several other major insurers have also waved the banner of altruism by similarly dropping co-pays and cost-shares on COVID-related care. The website for America’s Health Insurance Plans (AHIP), the industry’s biggest trade organization, has a list of all the big insurers and their official responses to COVID.

That’s because if you look at the fine print, you’ll see that the insurers are allowing their corporate customers with self-insured plans to opt out of this philanthropic display.

“In other words, these rules they say they’re putting in place, apply only to the people who are in the so-called “fully insured” health insurance plans. All their employer customers (ie the self-insured plans) have the opportunity to opt out. Who knows how many are opting out?! There is no way of knowing that. AHIP will not tell you that.”

No Standardization

Most Americans get their insurance via their jobs. Most of the large employers—the big corporations—are self-insured, which means they can opt-out of the insurance industry’s magnanimous offer to eat the copayments.

As a result, ordinary Americans might read the statements on the AHIP site and think that the waived cost-shares apply to them, only to find out that their particular companies have opted out.

Potter says there’s similar variability within the Medicare Advantage plans. “Cigna might be doing it (dropping COVID co-pays). But Aetna might not be doing it. Humana might be doing it, but Anthem might not. So, it really depends on what specific plan you are enrolled in, even if they’re all “Medicare Advantage” plans.

“So, it’s all over the place. There’s no standardization. You cannot believe what these health plans are saying, nor is there any reason to have certainty that they’re going to be doing the right thing for all the people enrolled in their health plans.”

To the extent that insurers really are waiving COVID costs for ordinary Americans, this is a positive step. But rest assured that on the insurance industry’s priority list, the public good comes well below profitability, CEO compensation, and shareholder return.

END